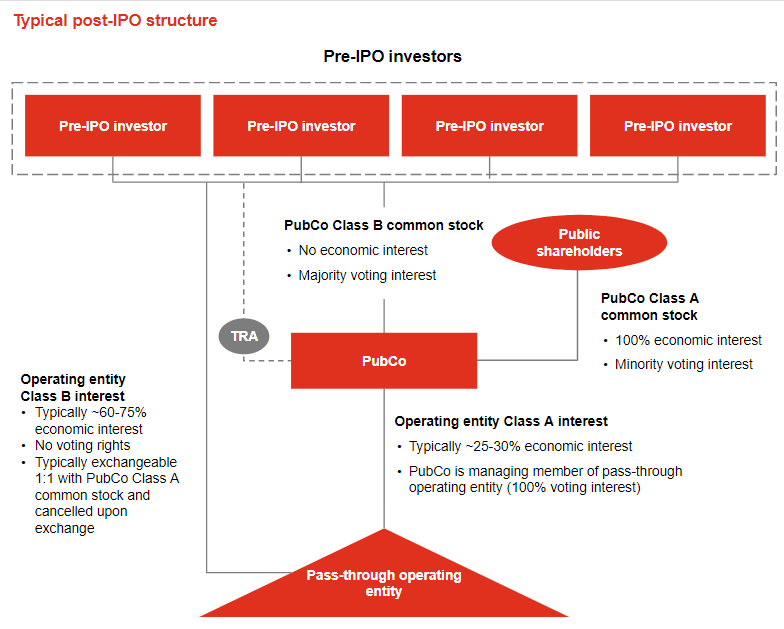

Tax receivable agreements in initial public offerings: An analysis of the innovation incorporated in IPO agreements

The Tax Receivable Agreement of the Red Rock Resorts IPO – Red Rock Resort/Station Casinos IPO Dissected

Moving Away from the C- Corporation: Understanding REITs, MLPs, PTPs and BDCs Thomas A. Humphreys Remmelt A. Reigersman November 30, ppt download

Tax receivable agreements in initial public offerings: An analysis of the innovation incorporated in IPO agreements | Semantic Scholar

Tax receivable agreements in initial public offerings: An analysis of the innovation incorporated in IPO agreements | Semantic Scholar

Amendment No. 1 to Tax Receivable Agreement, dated as of April | Veritiv Corporation | Business Contracts | Justia

Tax Receivable Agreement, dated February 12, 2021, by and among | Signify Health, Inc. | Business Contracts | Justia