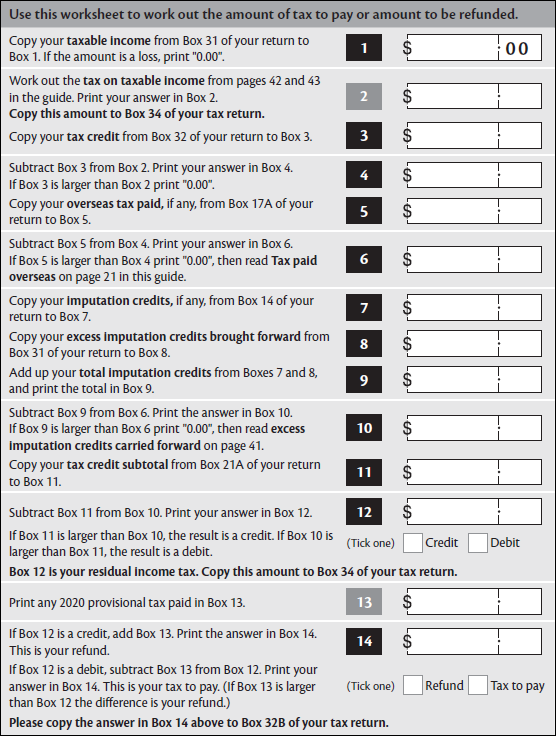

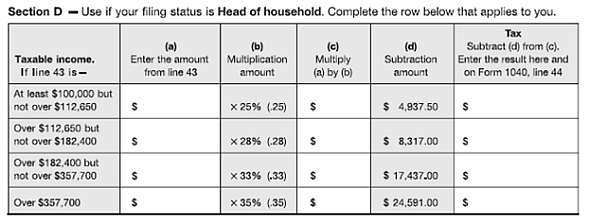

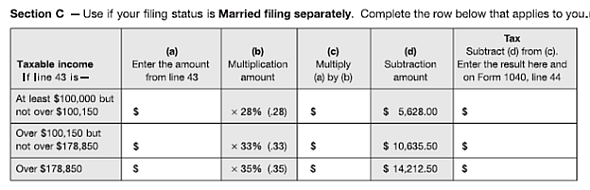

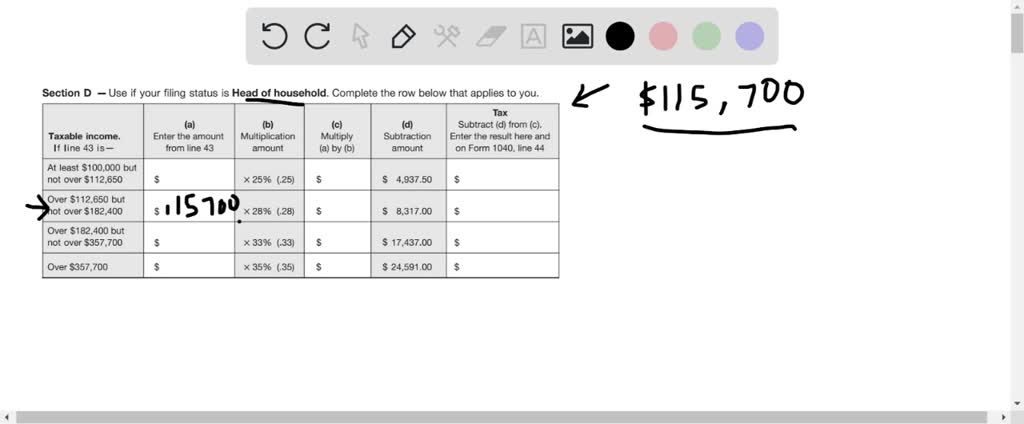

SOLVED:Use this tax computation worksheet to answer Exercises 11–14. table can't copy Calculate the tax using the computation worksheet for a head of household taxpayer with a taxable income of 115,700.

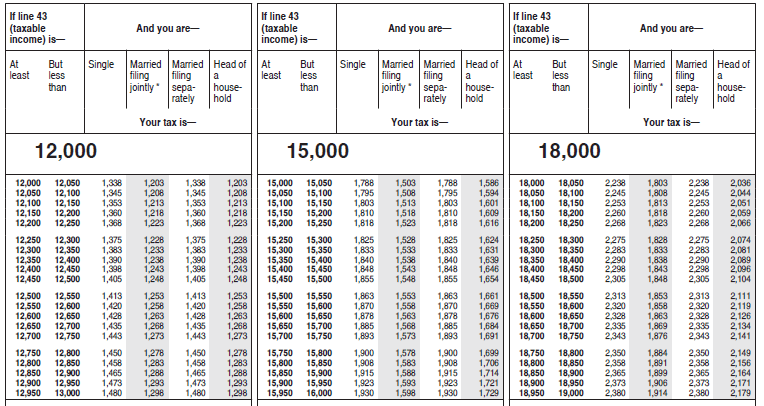

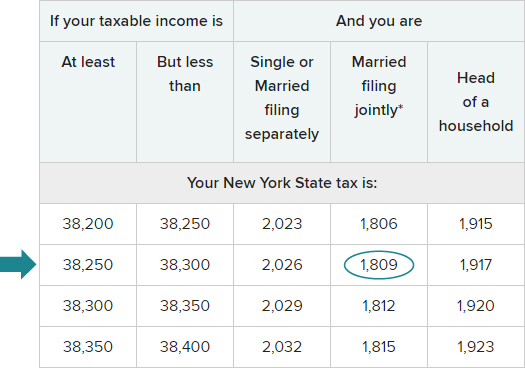

FIN5405 - Fm_chapter_6_review.docx - Name: _ Period: _ Score: _ Fm Chapter 6 Review Use This Portion Of The Tax Table To Answer #1–7. 1. (sm6-1:1) Abe Is Single. | Course Hero

Tax Rate Schedule I - Use if your filing status is Single, Married Filing Separately, or Dependent Taxpayer. Use the row in whi

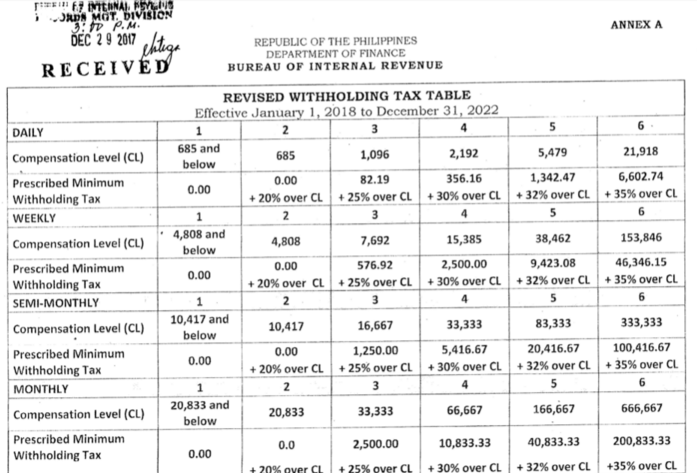

How to Compute Withholding Tax Based on the Newly Enacted TRAIN Law (Tax Reform for Acceleration and Inclusion) – Sprout Solutions

How Your Tax Is Calculated: Understanding the Qualified Dividends and Capital Gains Worksheet – Marotta On Money

:max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png)