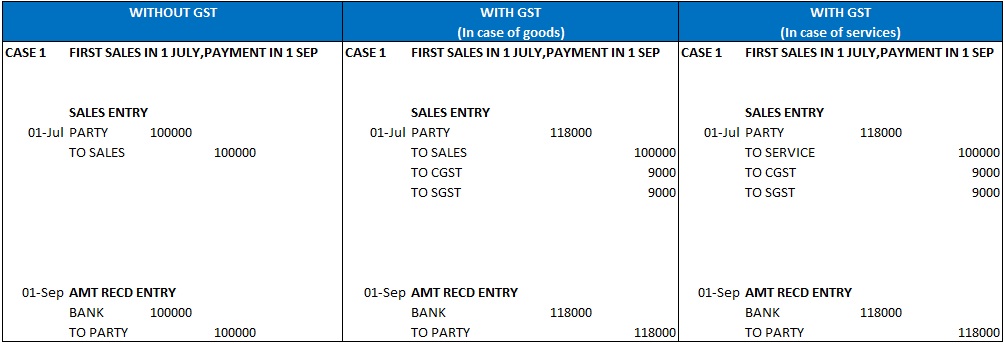

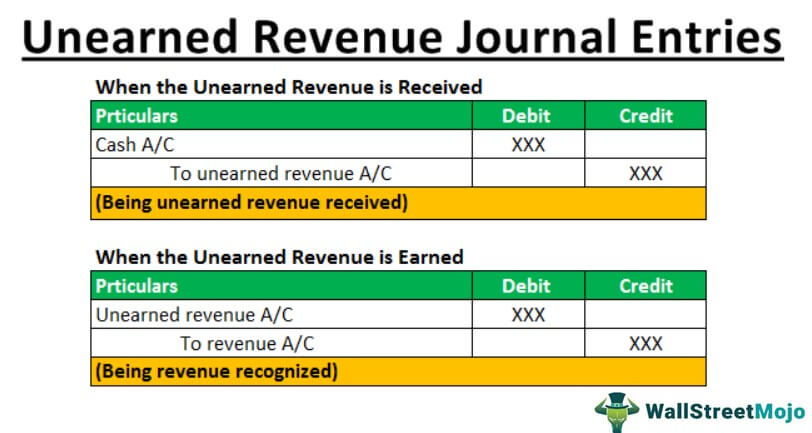

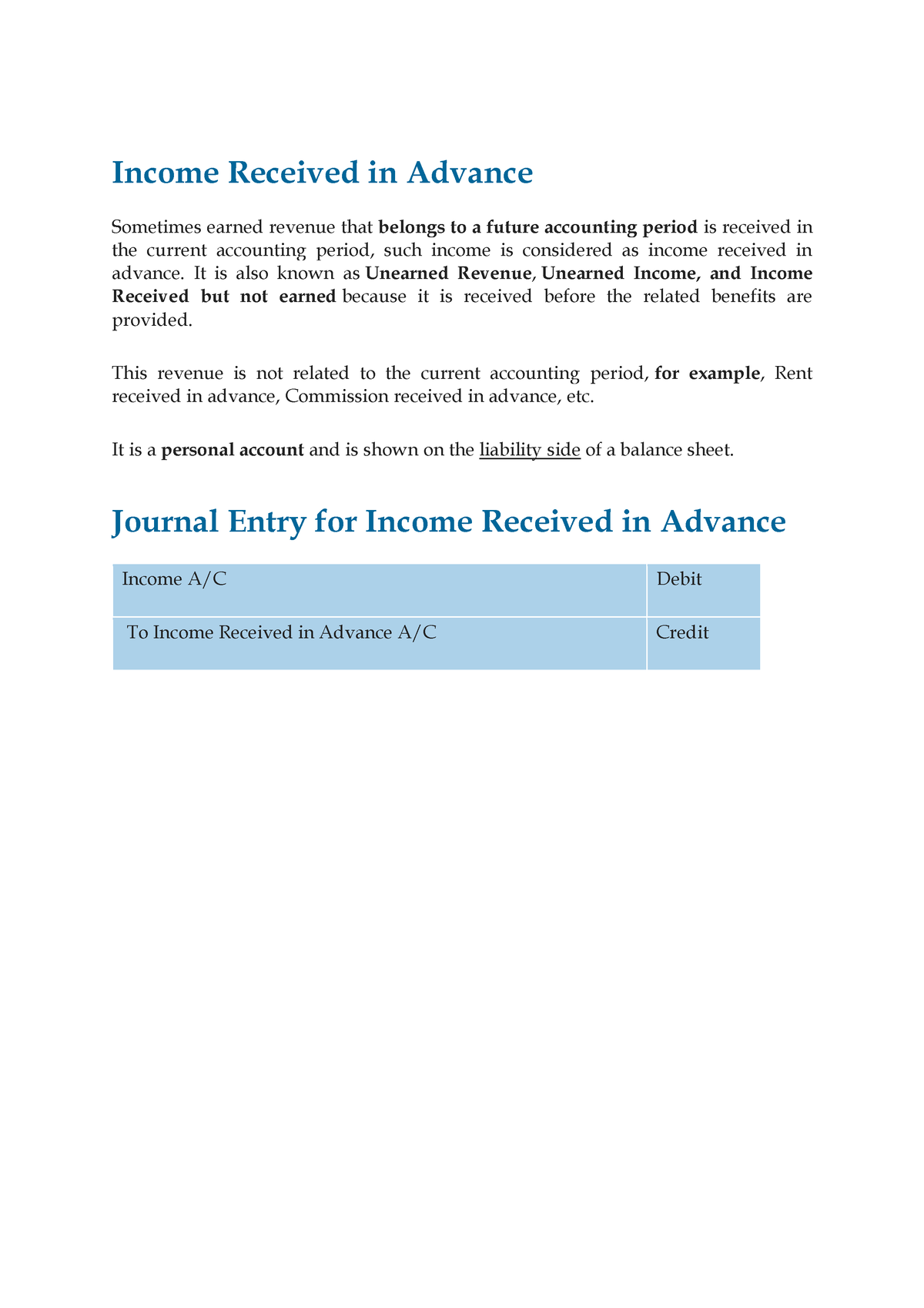

What is Income Received in Advance - Income Received in Advance Sometimes earned revenue that - Studocu

Stream episode Income Received In Advance Definition (adjustment) by Creativo Solutions podcast | Listen online for free on SoundCloud

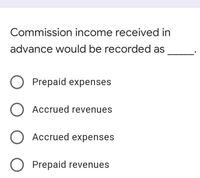

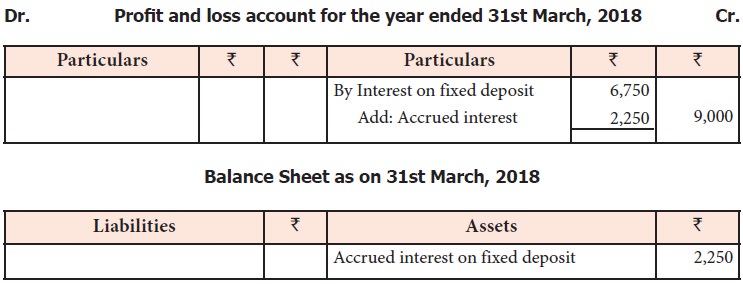

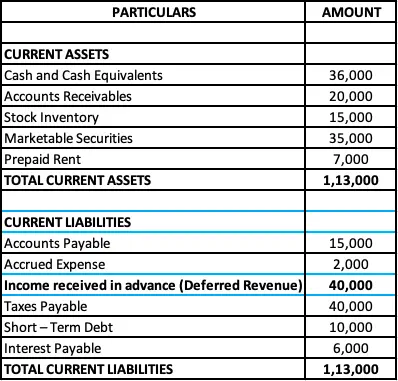

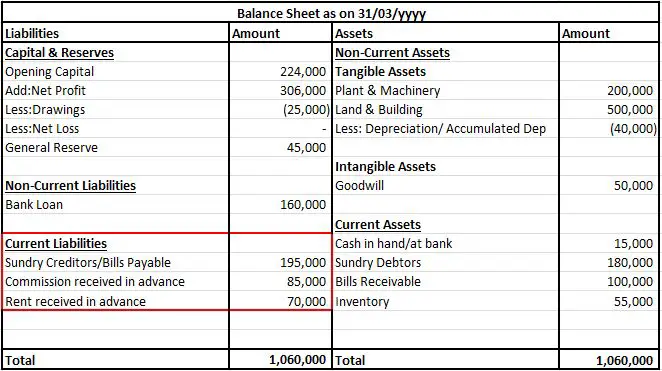

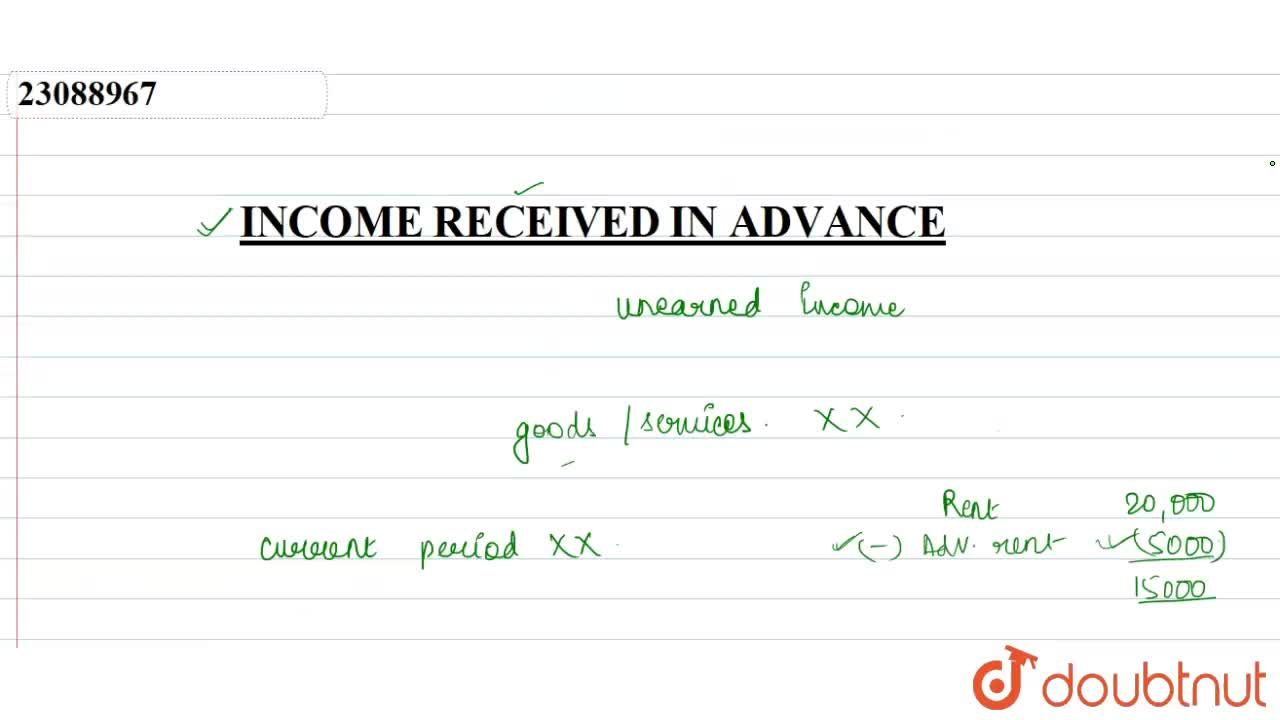

What is Income Received in Advance - Income Received in Advance Sometimes earned revenue that - Studocu

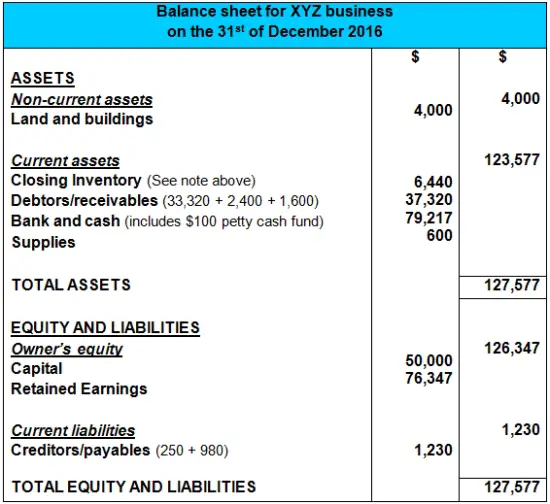

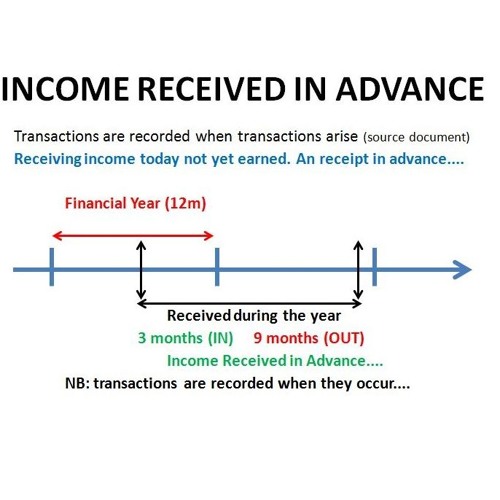

Accounting Practices 501 Chapter 8 Balance Day Adjustments (Income in advance & Accrued income) Cathy Saenger, Senior Lecturer, Eastern Institute of Technology. - ppt download