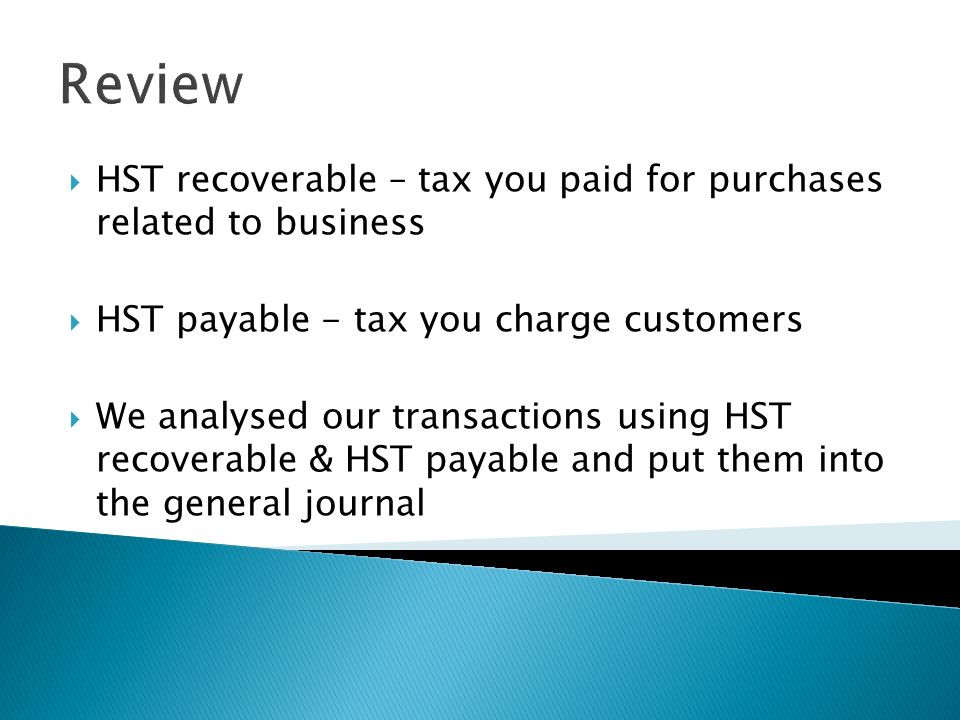

Review HST recoverable – tax you paid for purchases related to business HST payable - tax you charge customers We analysed our transactions using HST. - ppt download

Review HST recoverable – tax you paid for purchases related to business HST payable - tax you charge customers We analysed our transactions using HST. - ppt download

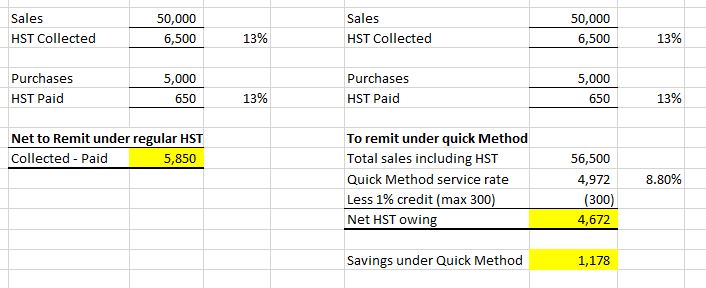

The Quick Method for HST – A great way to reduce HST owing. — Liberty Village Tax Accountant & Start-up Specialist | Erik Douglas

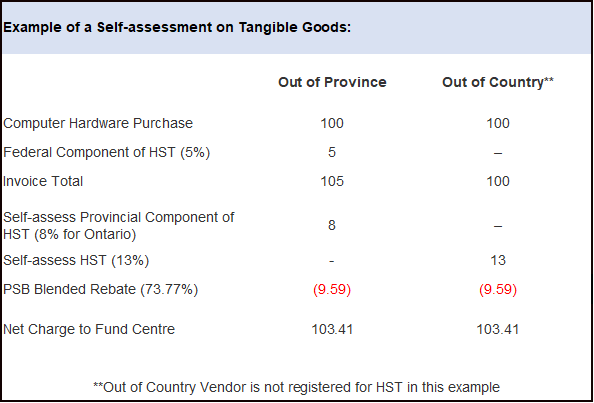

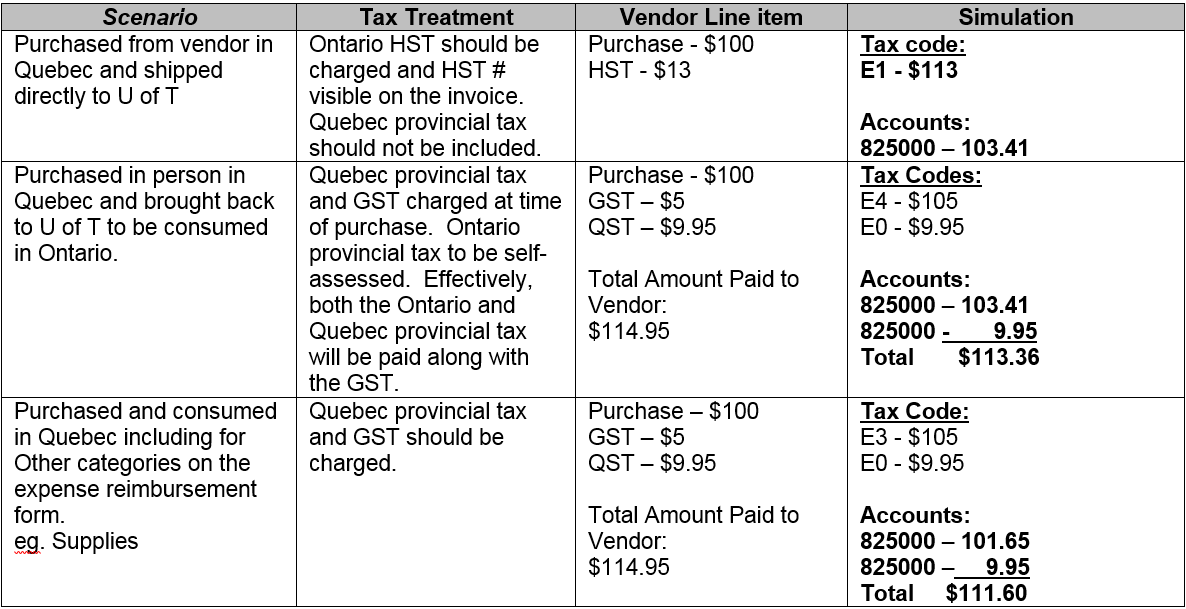

How do we handle the provincial sales tax for purchases from non-HST provinces & territories excluding expense reimbursements? - Financial Services

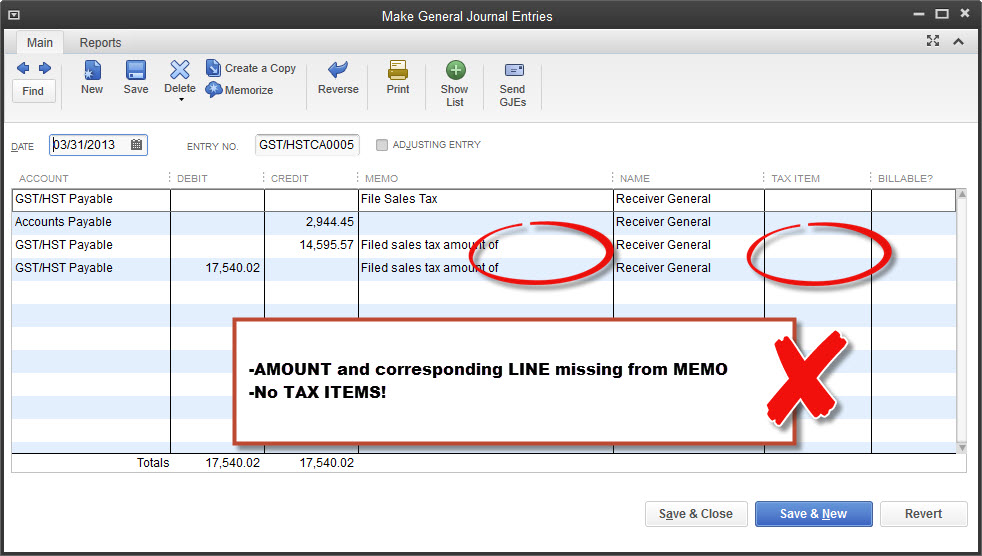

Why would the running balance in the GST payable account for the same period (last quarter) not correlate with the GST return amount?