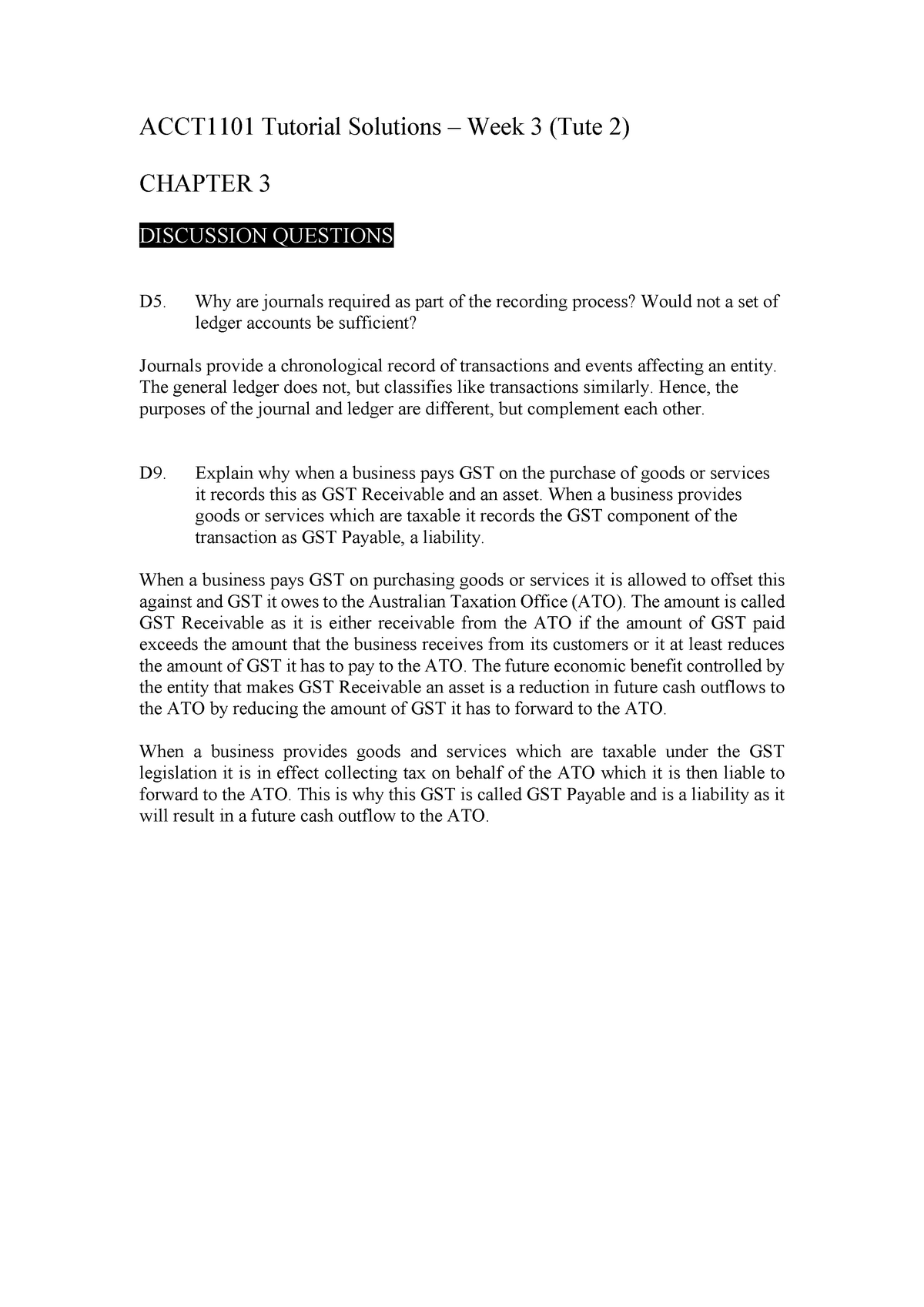

Tutorial Solution 2 - tute 1 - ACCT1101 Tutorial Solutions – Week 3 (Tute 2) CHAPTER 3 DISCUSSION - Studocu

Debits and credits flows including GST that happen for a prepayment in the T-Accounts - ExamSuccess Blog - Useful Money Stuff

Training - Modular Financial Modeling II - Sales Taxes - Financial Statements - Cash Flow Statement | Modano