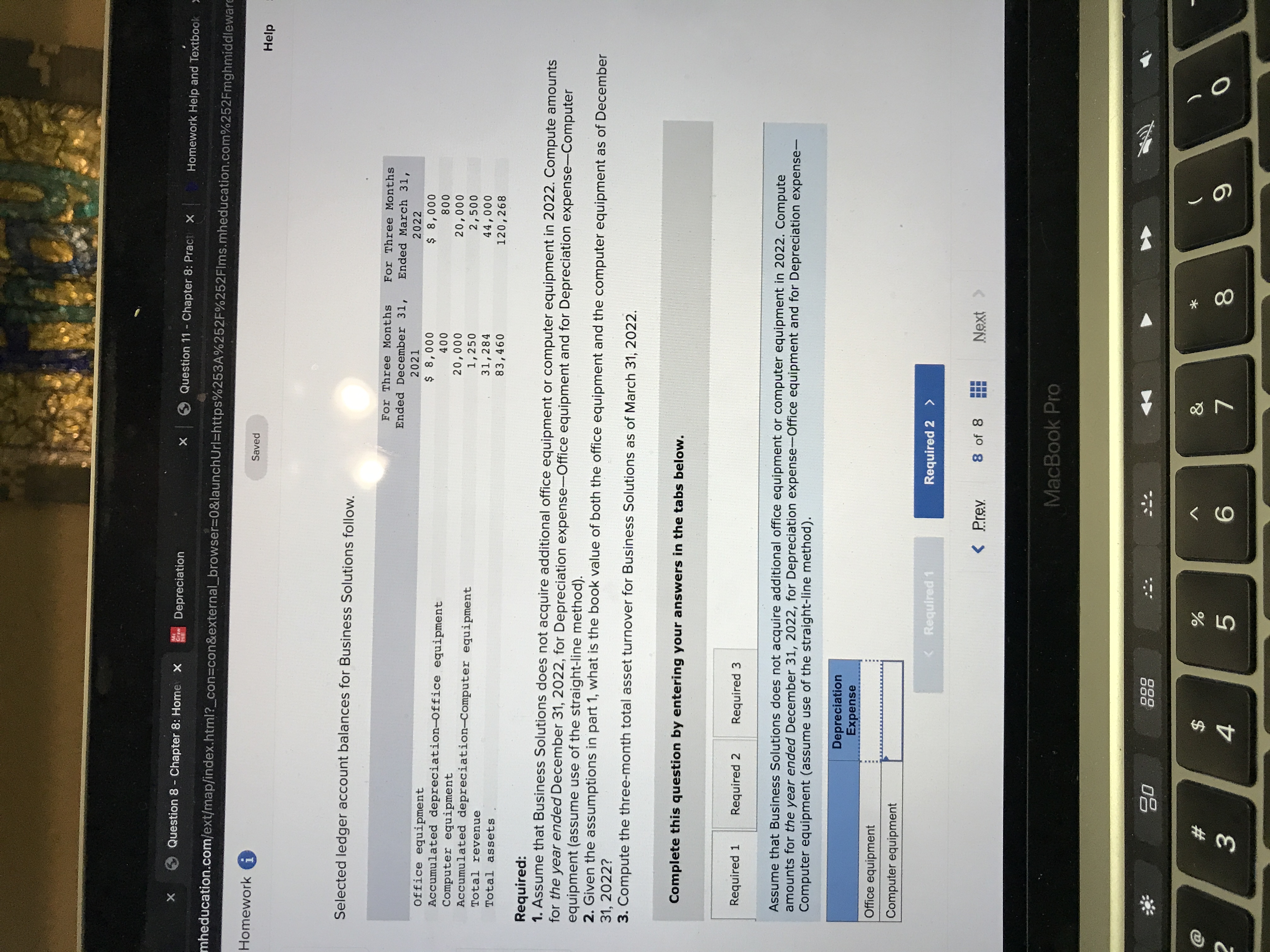

China Computer, Communication & Other Electronic Equipment: Cumulative Depreciation | Economic Indicators | CEIC

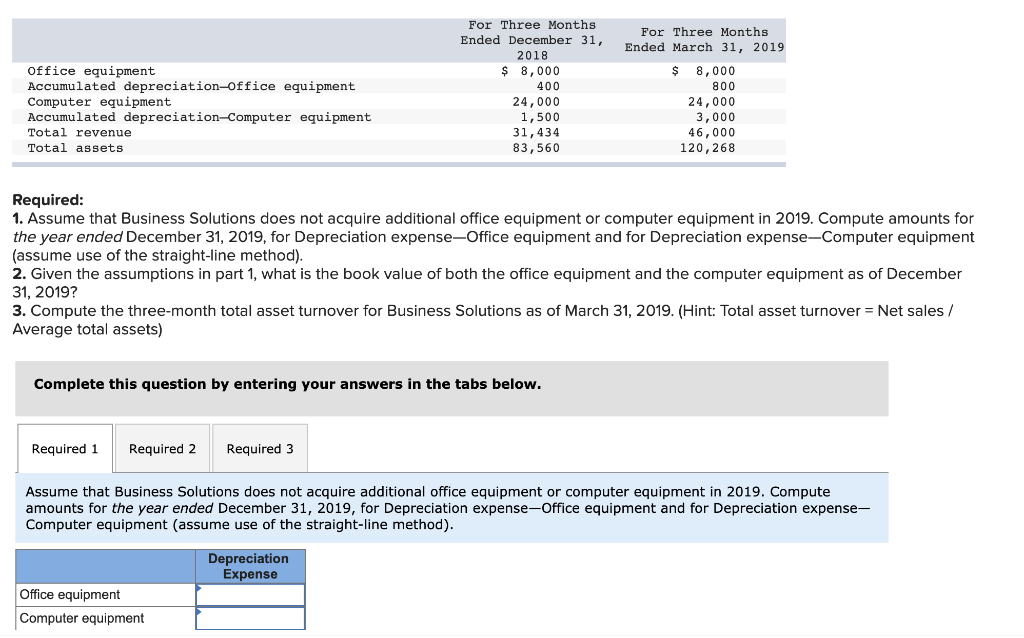

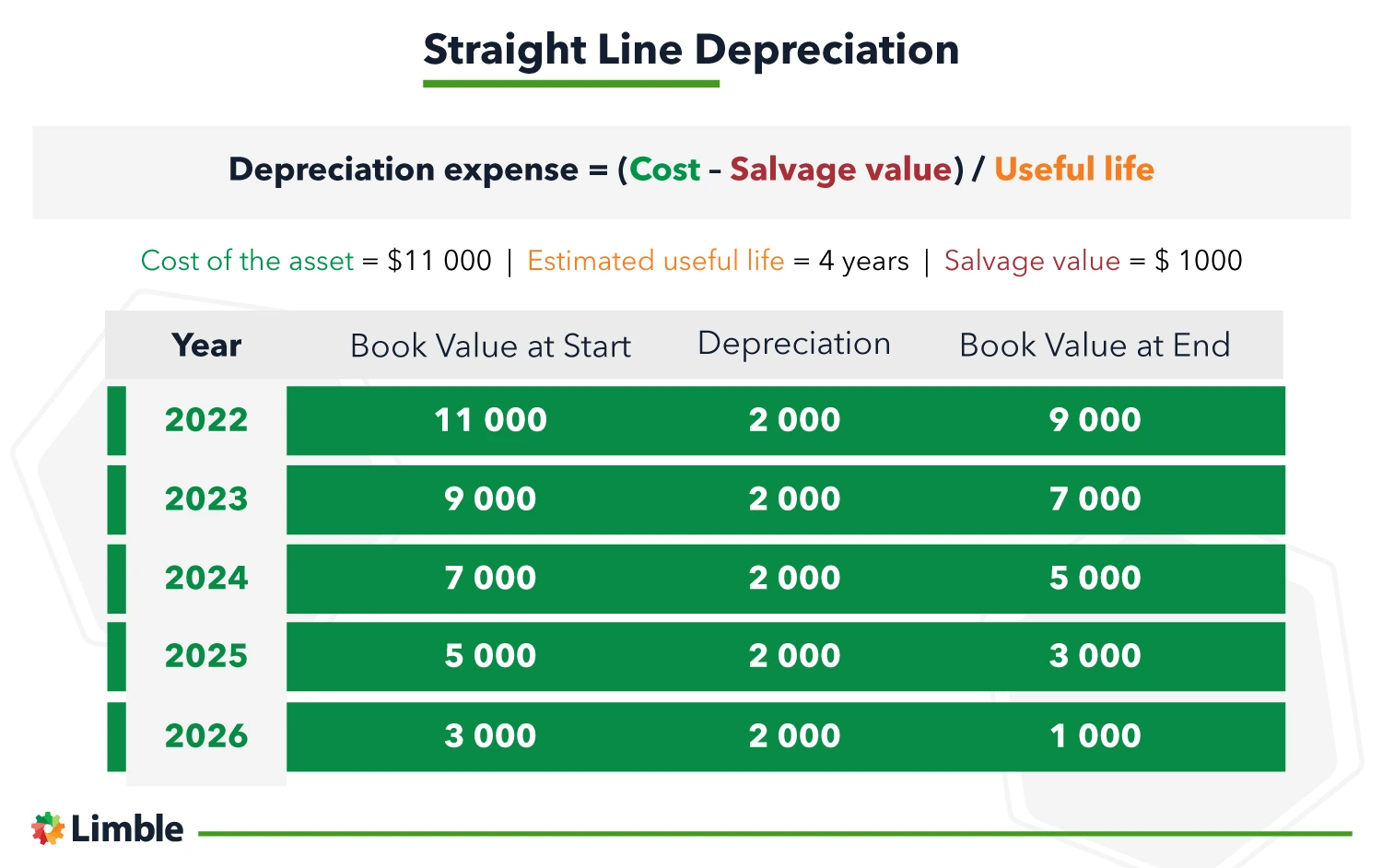

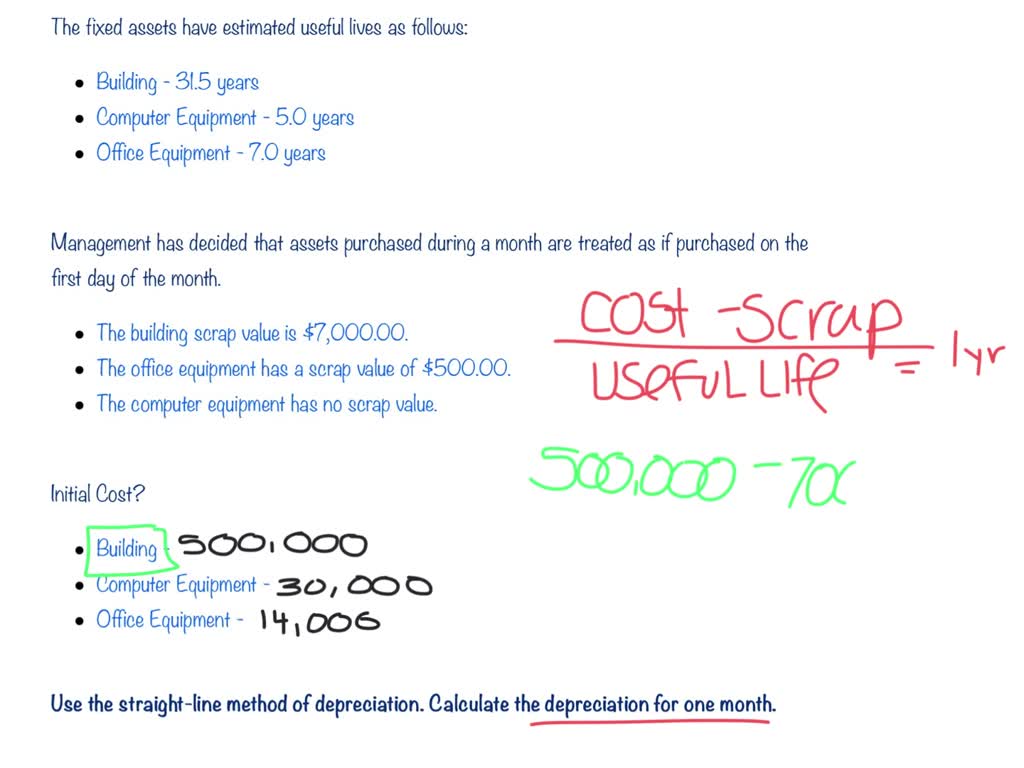

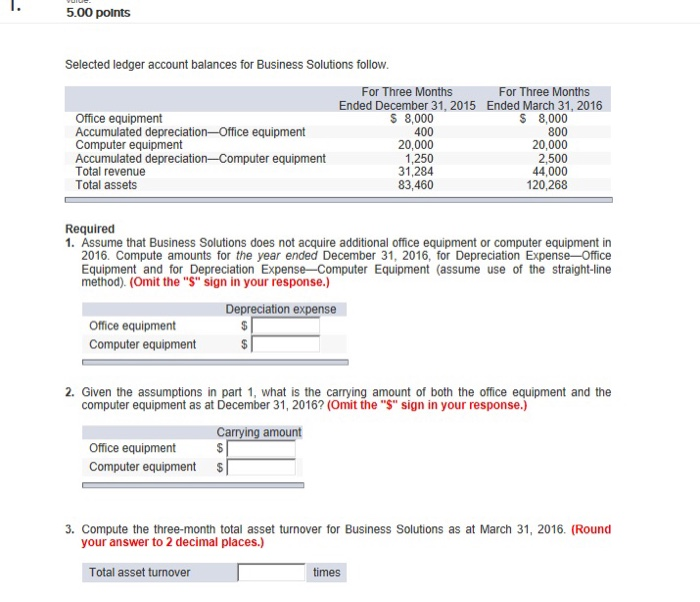

SOLVED: The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation. Management has

Accum. Depreciation/Depreciation expense: Custom control/expense accounts - #19 by San_Thida_Myo_Latt - Manager Forum

:max_bytes(150000):strip_icc()/Declining-Balance-Method-Final-68f11785576f4967a35f6ebb555f1fcb.jpg)