Mean changes in income from 2013 to 2015 computed in SPSS. The Wilcoxon... | Download Scientific Diagram

No additions towards excess premium if assessee valued shares at FMV computed in accordance with Rule 11UA of the Income Tax Rules, 1962: ITAT

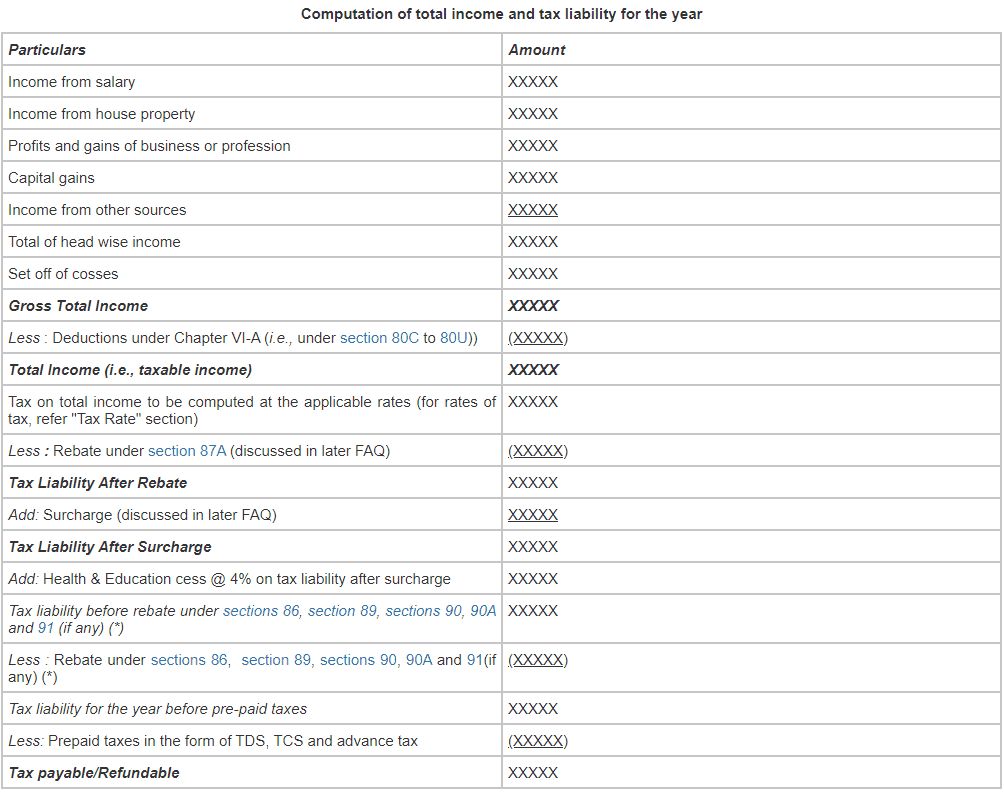

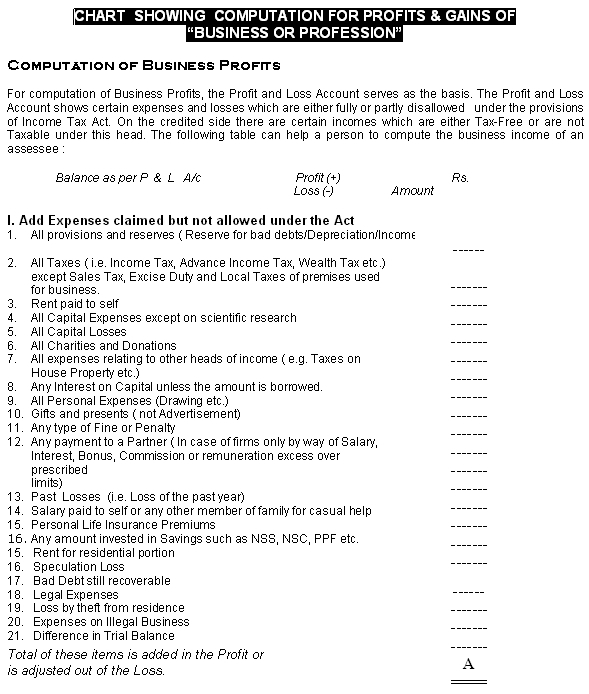

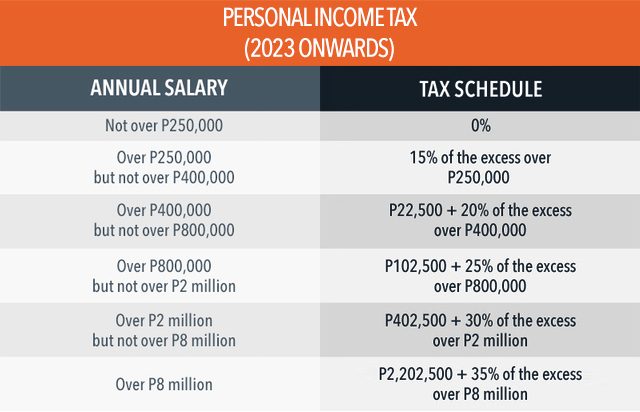

Freelancer's Tax Computation: Expenses, Total Taxable Income, How much tax to be paid, Other taxes that apply

![Computation of 'Salary' Income [Section 15-17] Computation of 'Salary' Income [Section 15-17]](https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Salary/Images/Computation-of-Salary-Income.jpg)

![Porting computed TDS to Saral PayPack [From income tax module] Porting computed TDS to Saral PayPack [From income tax module]](https://i1.wp.com/relyonsoft.in/spplaxmi/wp-content/uploads/2020/02/1.Porting-computed-TDS-TDS-details.png?resize=240%2C346&quality=100&strip=all)

![Computation of 'Salary' Income [Section 15-17] Computation of 'Salary' Income [Section 15-17]](https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Salary/Images/How%20to%20Compute%20Salary%20Income.jpg)

![Gross Total Income [Section-80B (5) ] - Definations under I.Tax. Gross Total Income [Section-80B (5) ] - Definations under I.Tax.](https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/Tax-Concepts/Gross-Total-Income-GTI-Image.jpg)