From the following details calculate net profit on accrual basis.ParticularsRs.Goods sold for cash 5,00,000 Credit sales 25,000 Cash purchases 4,00,000 Credit purchases 50,000 Wages paid 20,000 Outstanding expenses 10,000 Rent paid 5,000

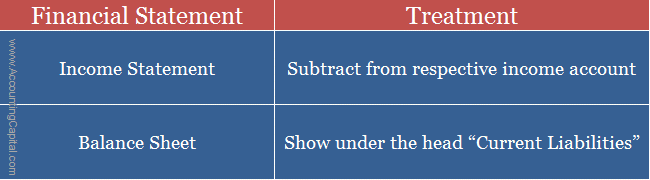

What is Income Received in Advance - Income Received in Advance Sometimes earned revenue that - Studocu

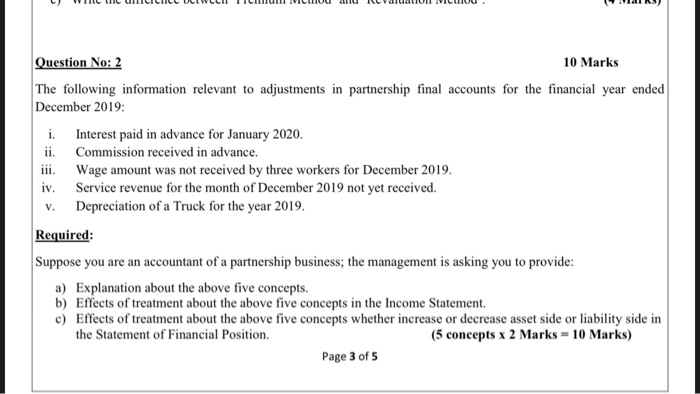

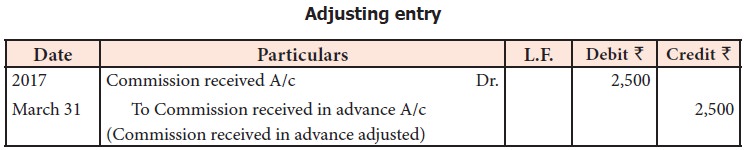

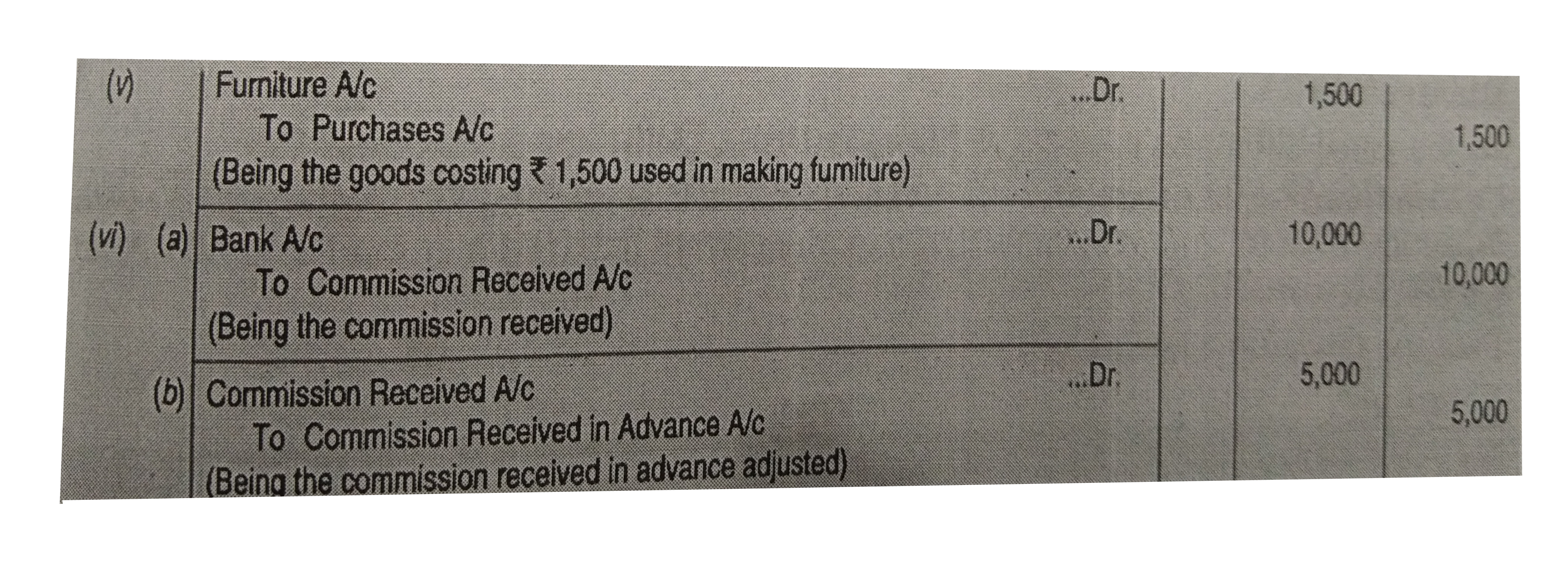

Pass Journal entries for the followings: (i) Interest due but not recevied Rs. 4,000. (ii) Salaries due to staff Rs. 25,000. (iii) Out of the rent paid this year, Rs. 2,000 relates

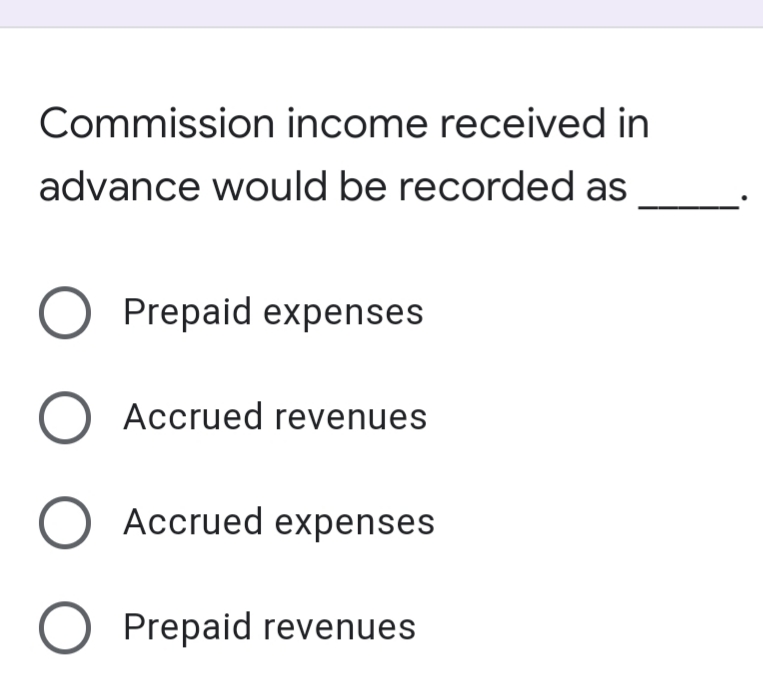

Prepare Accounting Equation from the following: Started business with Cash Rs 60,000. Rent received Rs 2000. Accrued interest Rs 500 Commission received in advance Rs 1000. Amount with drawn Rs 5000.? | EduRev Commerce Question

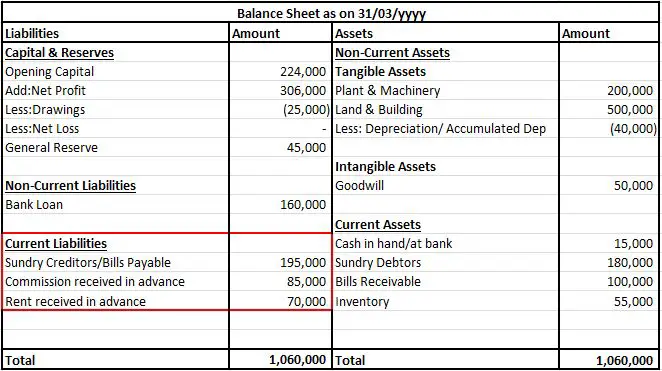

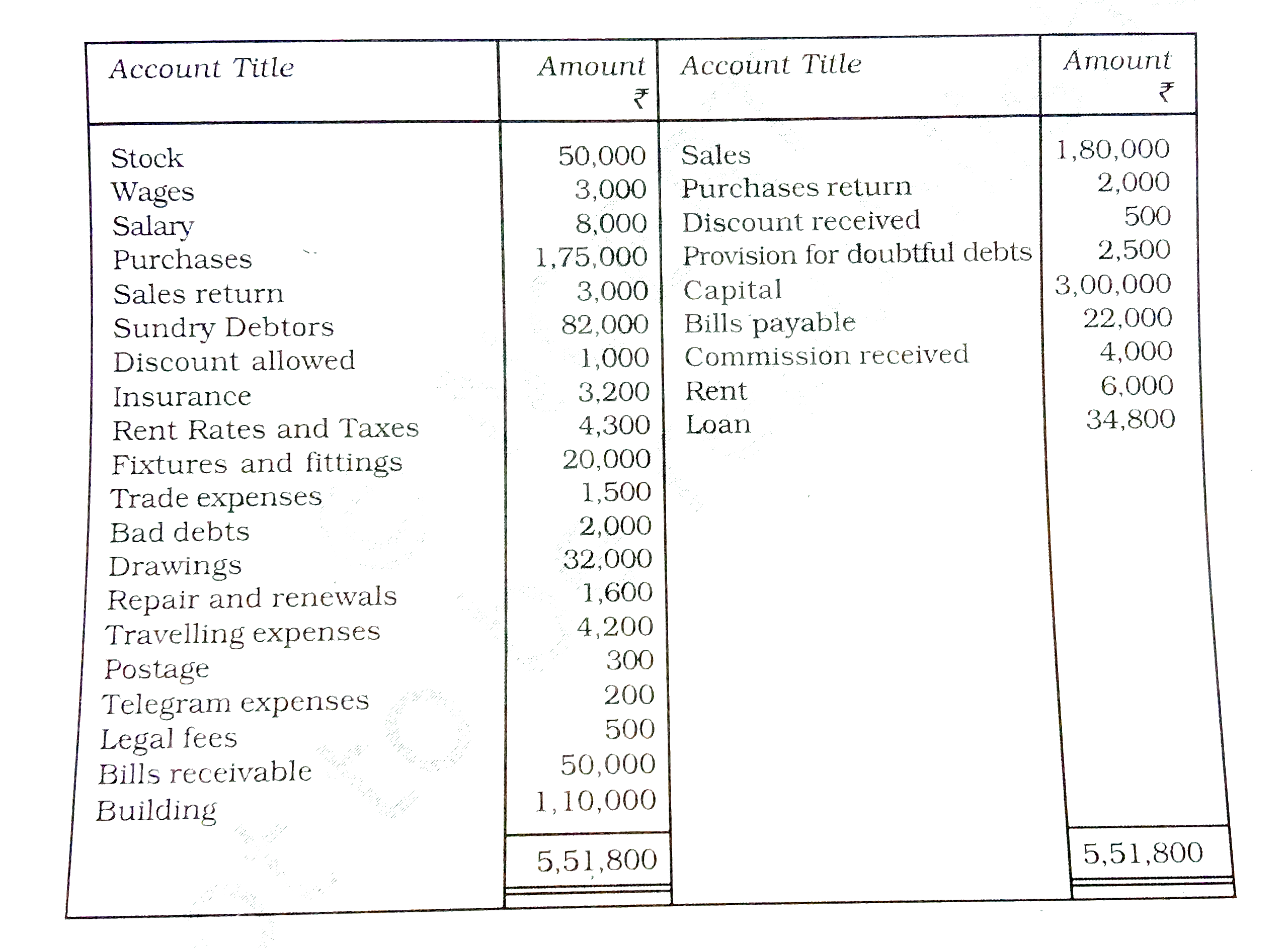

Prepare a trading and profit and loss account for the year ending March 31, 2017. from the balances extracted of M/s Rahul Sons. Also prepare a balance sheet at the end of

From the following details calculate net profit on accrual basis.ParticularsRs.Goods sold for cash 5,00,000 Credit sales 25,000 Cash purchases 4,00,000 Credit purchases 50,000 Wages paid 20,000 Outstanding expenses 10,000 Rent paid 5,000

Suppose P start a business with Rs. 50,000 cash and then buys furniture from F.F. Co. on credit for Rs. 2,000 . Now, the accounting equation Assets = Capital + Liabilities will be .

From the following details calculate net profit on accrual basis.ParticularsRs.Goods sold for cash 5,00,000 Credit sales 25,000 Cash purchases 4,00,000 Credit purchases 50,000 Wages paid 20,000 Outstanding expenses 10,000 Rent paid 5,000

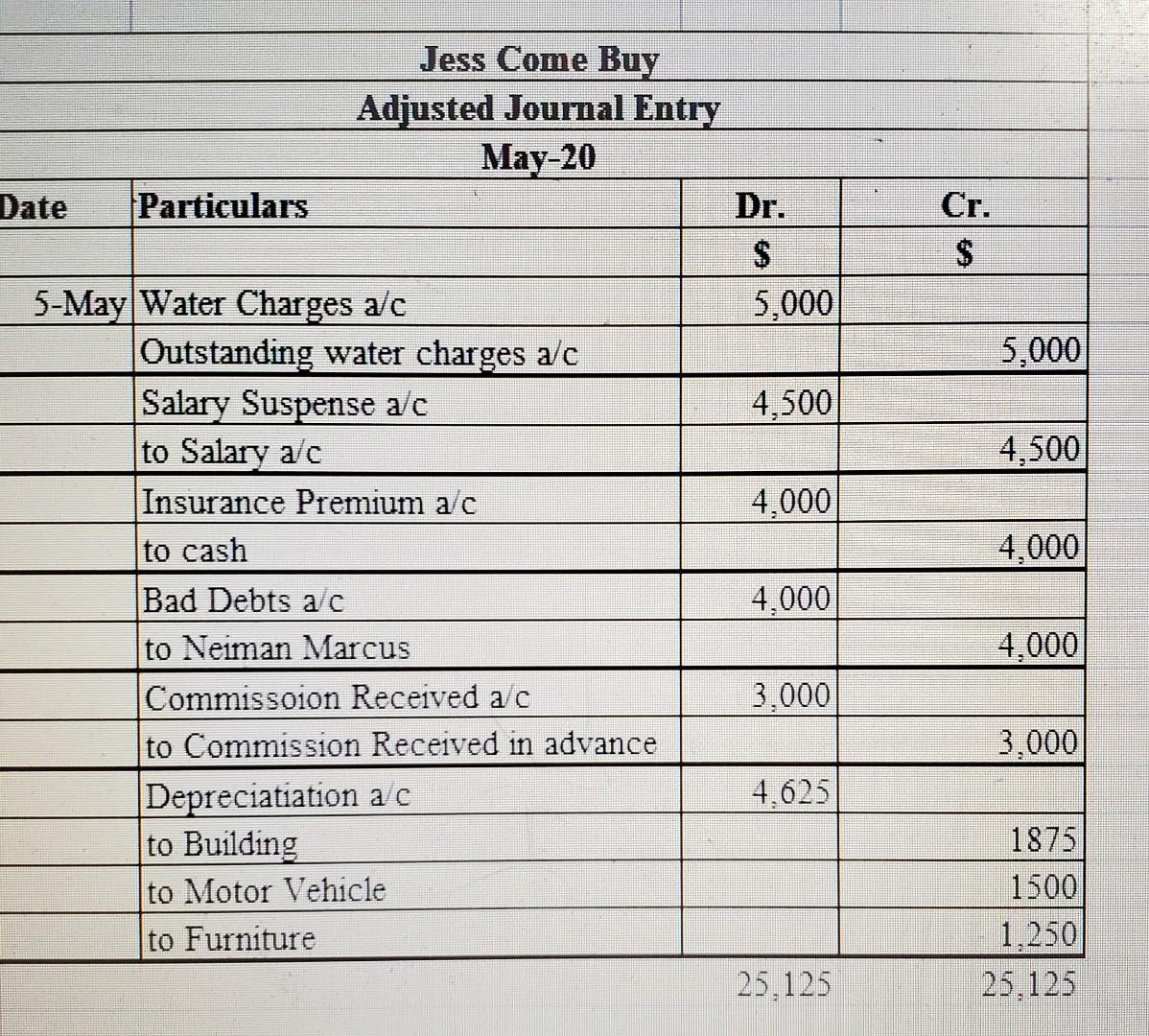

Chapter # 4 Completion of Accounting Cycle. Accounting Period & Financial Statements For the purpose of measuring net income and preparing financial statements, - ppt download

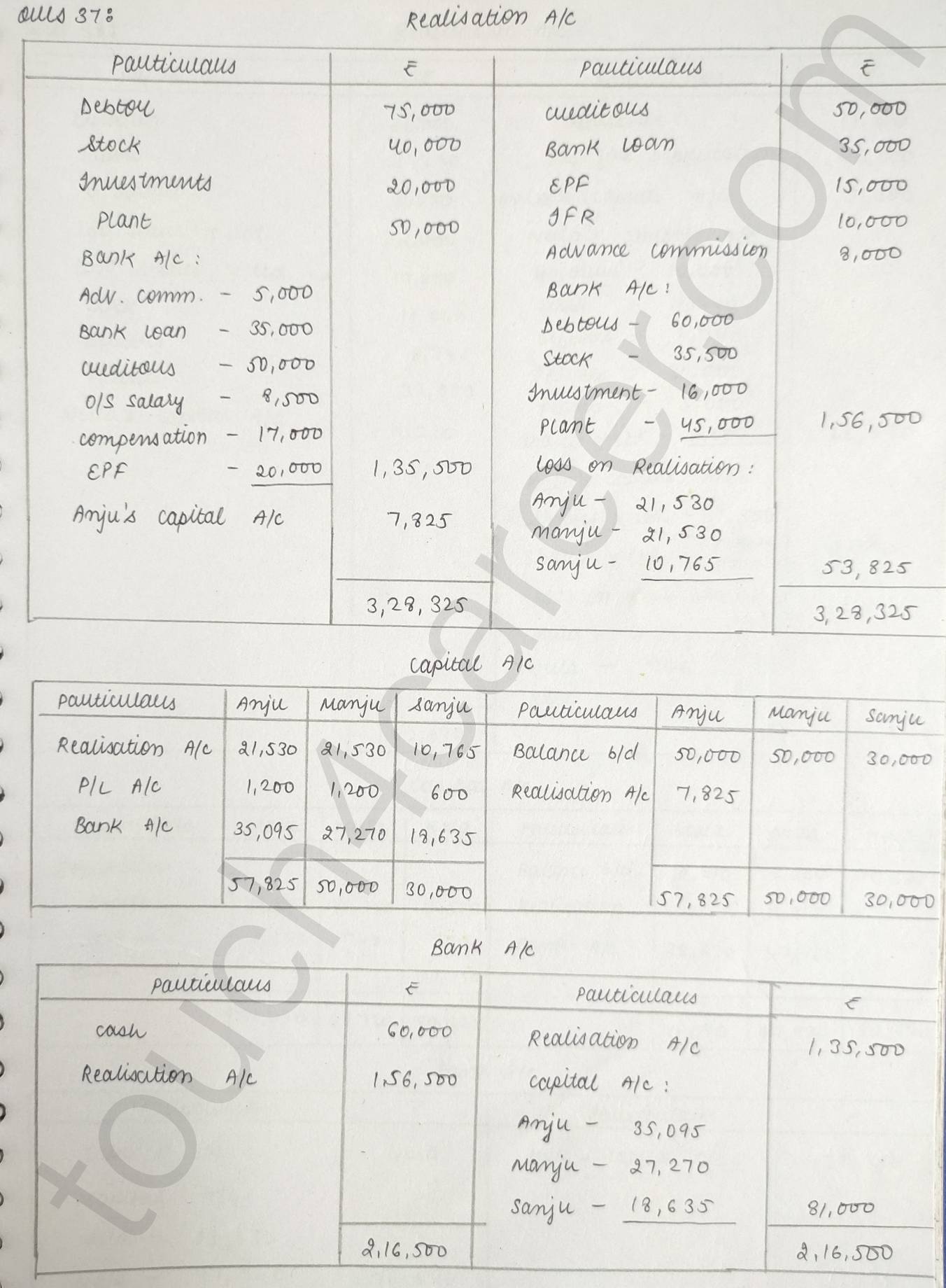

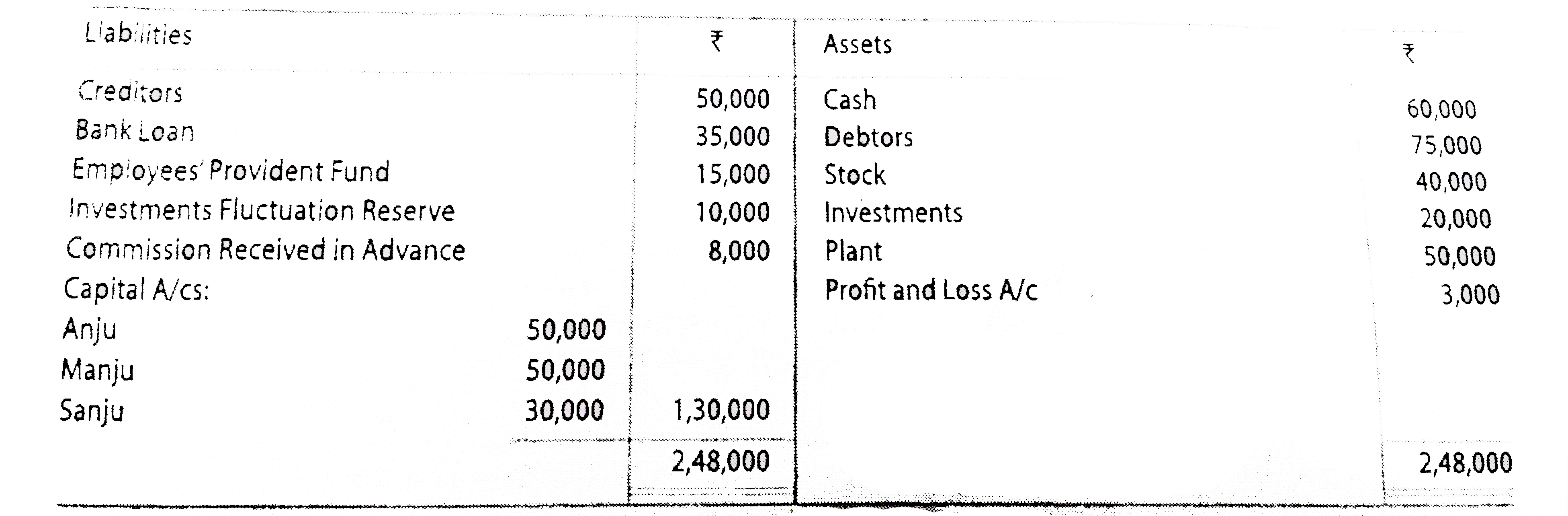

Anju , Manju and Sanju were partners in a firm sharing profits in the ratio of 2 : 2: 1 . On 31st March 2019, their Balance Sheet was : On this